The global market for mobile geared products grew slightly (0.6%) to $11.2 billion last year, driven by the EMEA and Americas regions, and is expected to register a compound annual growth rate (CAGR) of 1.5% between 2021 and 2027.

Affected by the stagnant off-highway vehicle market in China, the global market for geared products used in mobile applications was estimated to grow marginally by 0.6% to $11.2 billion in 2022, while total unit shipments registered a slight decrease of 2.5% to 8.0 million units in 2022. Furthermore, the market is expected to grow at a 1.5% revenue CAGR during 2021 to 2027 to $12.2 billion in 2027, with unit shipments up by 3.1% annually to 9.9 million units.

From a regional market perspective, EMEA is anticipated to be the best performing region in terms of geared product sales during the period of 2021 to 2027, with a projected revenue CAGR of 3.5%, followed by the Americas region, with 2.9% annual growth. Asia Pacific will grow most slowly, at just 0.1% per annum, with sales negatively affected by the sluggish construction vehicle market in China.

Market competitive landscape

The global supply of mobile geared products comprises both OEMs and independent component suppliers, with the latter remaining the majority suppliers. Furthermore, independent companies are mainly dedicated geared product (drive axle and gearbox) suppliers (e.g. ZF, Dana, Bonfiglioli) and mobile hydraulic companies (e.g. Bosch Rexroth, Kawasaki). Hydraulic component companies tend to not only be buyers of geared products, but are also engaged in the supply of geared products to sell, either together as part of systems or separately.

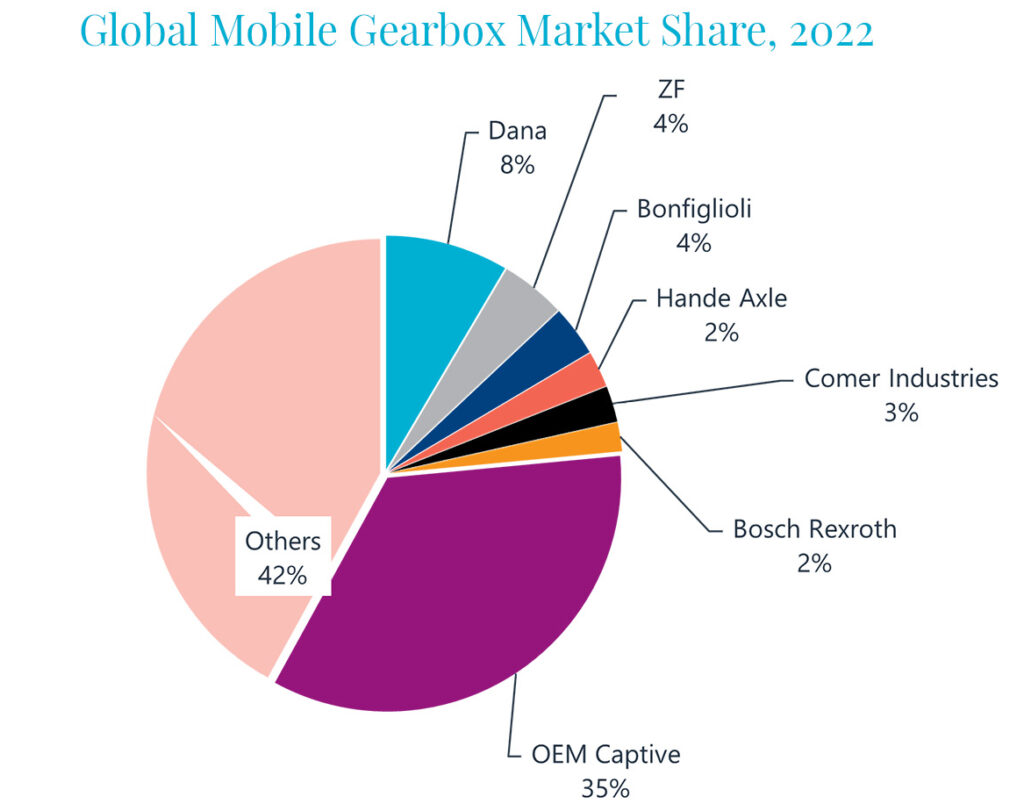

The global market landscape of geared products for mobile applications is rather fragmented, with the top 5 vendors together accounting for an estimated 23.5% market share in 2022, and the OEM captive supply made for around 34.5%.

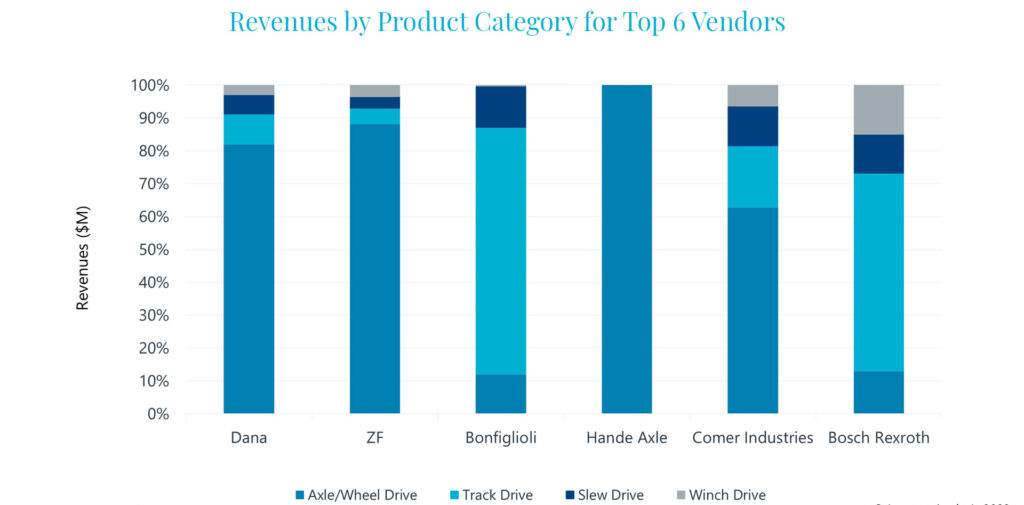

Broadly speaking, European and US vendors have strong influence in the global mobile gearbox market. Furthermore, owing to the wide range of applications, axle/wheel drives were the largest product type in 2022, accounting for 65.6% of total revenues, enabling axle/wheel drive companies to increase their presence in the market overall. Dana ranked top, with an estimated 8.5% market share in 2022, thanks to its strong sales of axle/wheel drives. Meanwhile, German company ZF earned second place with a 4.5% share of the market, again largely due to its axle/wheel drive capability. Hande Axle and Comer Industries shared fourth position, each with an estimated 2.0% of the global market. Hande Axle benefited from its leading presence in China’s domestic market, however, the company had a very limited presence outside of China in 2022.

More uniquely, as the third largest player with around 3.5% market share, Italian vendor Bonfiglioli’s geared product offerings range from planetary track drives and slew drives to winch drives. It was the largest supplier for mobile geared products (excluding axle/wheel drives) to the global market, accounting for around 9% of total sales in 2022. In addition, Bosch Rexroth, which ranked 6th, also generated its sales from track, slew and winch drives, and the company was the second largest player for non-axle/wheel mobile gearboxes with an estimated share of 5.0% of the non-axle/wheel mobile gearboxes segment in 2022.

From a regional perspective, each major region has its own features in terms of supplier landscape. European and US companies dominate supply in the EMEA and Americas region. Dana and ZF ranked as the top two in both regions, with limited presence of Asian vendors. However, the Asia Pacific market was led by Japanese and Chinese vendors, largely due to their strong performance in China. Chinese axle manufacturer Hande Axle ranked top in 2022, due to its strong presence in the mobile crane and haul/dump truck markets in China. Dana took the second spot and also performed strongly in the axle/wheel drive sector, particularly for AWPs (aerial working platforms). Japan-based Nabtesco ranked the third.

Bottlenecks drive trend towards localized supply

Over the past two years, our research showed that supply chain bottlenecks pushed OEMs to lean further towards the internal supply of geared products. Leading off-highway vehicle OEMs intend to integrate component production, such as track drives and axle drives, for better supply chain management and total cost control. But small and medium-sized OEMs lack capability for in-house component production and rely on independent component suppliers.

The landscape of OEM captive suppl” and third-party company supply is generally stable in developed markets, while in developing markets (such as in China), major OEMs like SANY, XCMG have been increasing investment in building their own internal component production capacities, which includes geared products, and this trend is expected to continue in the future. We estimate OEM captive supply accounted for approximately 34.5% of the total global mobile gearbox market in 2022, one percentage point up from the previous year. Trending with ups and downs of the global off-highway vehicle market and electrification, the supplier landscape is expected to gradually evolve in the future.

Source: Interact Analysis

Read the full article here