According to the latest market study by Interact Analysis, the global market for mobile hydraulics is projected to contract by 6.7% in 2024. This downturn follows a period of significant growth in 2021 and 2022. The market is expected to be valued at $17.5 billion by the end of 2024, down from $18.8 billion in 2023. However, the global mobile hydraulics industry is expected to return to growth in 2025 with 2024 seen as a turning point for the market.

Economic uncertainty, including high borrowing costs and political instability globally, is a major factor contributing to the market’s current decline. Coupled with over-stocking during the supply chain crunch of 2021 and 2022, this has led to a period of destocking by OEMs and distributors, further slowing the market in 2024.

Construction and agriculture in decline, APAC buoys sector

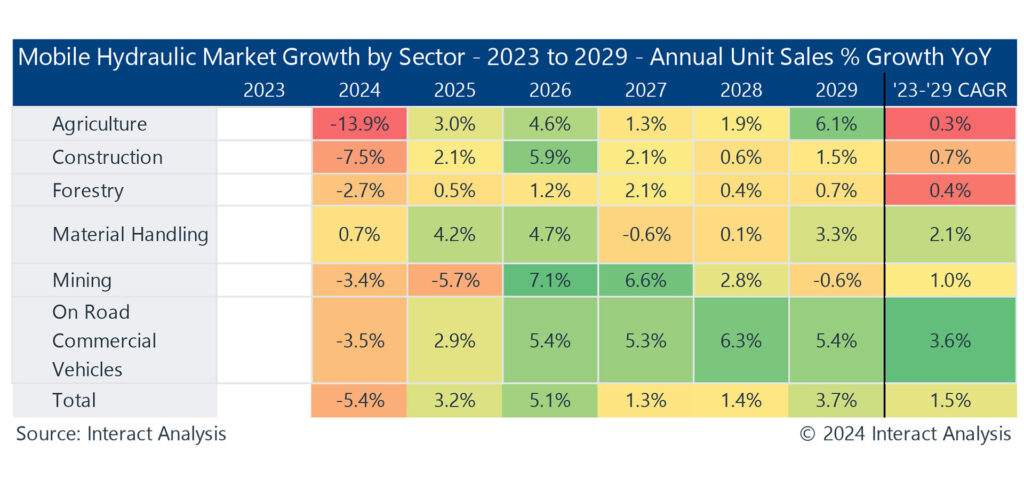

The global construction sector’s poor performance is dragging down the overall market in the Americas, which represents 46.5% of the region’s mobile hydraulics revenue. Europe is experiencing declines across all sectors due to economic challenges, including higher energy costs precipitated by the conflict in Ukraine and a de-coupling of Europe from Russian natural gas. The Asia-Pacific region is expected to post the highest compound annual growth rate (CAGR), driven by strong demand in the material handling and mining sectors.

Vehicle electrification will reshape the market

While the immediate outlook for the mobile hydraulics market is challenging, there are longer-term trends that offer significant growth potential. One of the most important of these is the ongoing trend toward electrification, particularly in the off-highway vehicle market as many OEMs flag 2030 as a key date for their sustainability plans. Although full hydraulic system replacement is unlikely in most high-power applications, electrification is expected to drive significant changes in system design. Decentralized hydraulic systems, which can improve energy efficiency, are likely to become more prevalent, helping OEMs meet stricter emission and efficiency targets. However, the hydraulic valve market could be negatively impacted as fewer are needed in a decentralized or fully electric system.

Cyclical nature of growth

The current downturn in the mobile hydraulics market can be attributed to several converging factors, most notably the global economic climate and a widespread effort to reduce overstocked inventories. In the wake of supply chain disruptions seen in 2021 and 2022, many OEMs and distributors significantly over-ordered hydraulic components to mitigate potential shortages. This led to an overstocking scenario, which combined with a slowdown in demand caused destocking, and this is weighing heavily on the market.

However, the United States Federal Reserve’s interest rate cuts are likely to kickstart a new cycle of growth for the mobile hydraulics sector. The US dollar has long been the lynchpin of the global economy and any reduction in interest rates often results in market growth around the world.

“While a decline is unfortunate, such slowdowns have become expected in the mobile hydraulics market, which can be characterized as extremely cyclical. A typical cycle will see growth peaking and troughing every 3 to 5 years. The last peak was 2021, when growth was in the double digits. This growth has slowed since then and we expect 2024 to represent the trough of the current cycle, with growth returning in 2025.”

said Blake Griffin, Research Manager at Interact Analysis.

Read the full article here